Crowdfunding has gained a lot of fans in recent years and is gradually replacing other financing methods, such as bank loans. Crowdfunding can be summed up as a process in which a company takes the capital it needs directly from the people and actually uses the total small capital of each person to advance its goals and launch projects. In general, we can say that there are 4 types of crowdfunding, which we will talk about below.

Read more : crowdfunding strategy : How do we outperform our competitors?

Table of Contents

Types of crowdfunding

- Debt-based or peer-to-peer lending (P2P) investment: The amount invested in this case is actually considered as a loan that must be repaid in addition to an amount of profit.

- Equity crowdfunding: This type of investment, which is gaining more and more popularity in the world, is actually a way to attract capital in exchange for the transfer of company shares. In fact, in this case, investors will be part of the company’s shareholders and can play a role in the company’s decisions and management to some extent. Of course, since most people have little capital, the impact of an investor alone on the company will not be great.

- Donation-based crowdfunding: This type of investment is mostly about charitable, non-profit, and community projects. As the name implies, in this case, people pay the other party without expecting a return on investment.

- Reward-based crowdfunding: This method is similar to donation-based investment, but with one difference. In this case, the investors receive a non-financial reward for their investment. For example, in return for their investment, they receive a portion of the final product or certain models of the company’s product.

Benefits of crowdfunding for startups

One of the most common misconceptions about crowdfunding is that it is thought to be just for startups. Although startups and small businesses can use this method well to provide the capital they need, this does not mean that this method can not be used by larger and more developed businesses!

- Easier access to capital: As we know, raising capital through conventional and traditional methods, such as borrowing from banks, is usually difficult for small businesses and startups. One of the benefits of crowdfunding is that it replaces the company or bank that trades with a large number of investors. In general, raising capital from the public is far easier than raising capital from banks and financial institutions, which makes it possible for startups to provide comfortable and hassle-free capital. Of course, for crowdfunding, you have to make a good offer to your investors. Don’t forget that each of your investors will grant you their money and capital to make more profit. So it’s a good idea to show them the reality of your company’s situation and set realistic financial goals so that you don’t get in trouble with investor expectations in the future.

- Companies’ Representatives: We all want to spend our capital and time on business with a bright future. A company that we believe in its efficiency and success of its products or services. This trust can benefit startups. Startup investors themselves become representatives of the company and help to promote and inform the company. For example, you can help dissemination, trust-building, and promoting your business by actively engaging and updating their information during the provision of new services.

- Crowdfunding in different parts of the world: One of the main benefits of crowdfunding is that there are no restrictions on attracting investors. Every year, the amount of capital provided through crowdfunding increases, and it seems that the growth in popularity of this method will continue in the coming years. Of course, the share of each company or project in this process is definitely different depending on their field of activity and other factors. More importantly, this growth does not happen equally in all countries of the world. In Europe and the United Kingdom, crowdfunding has grown the most. For example, countries such as Germany, Spain, and Belgium are among the pioneers of this trend. On the other hand, in the United States, donation and reward-based platforms have grown the most.

Failure and success in crowdfunding

We’ve all heard the story of successful companies that have made great strides by overcoming various obstacles. At first glance, it may seem that raising capital through crowdfunding is very simple and brings us a 100% win. But this is not the case. We usually hear the success stories of companies, and we don’t know about the other side of the coin that some businesses go bankrupt and fail.

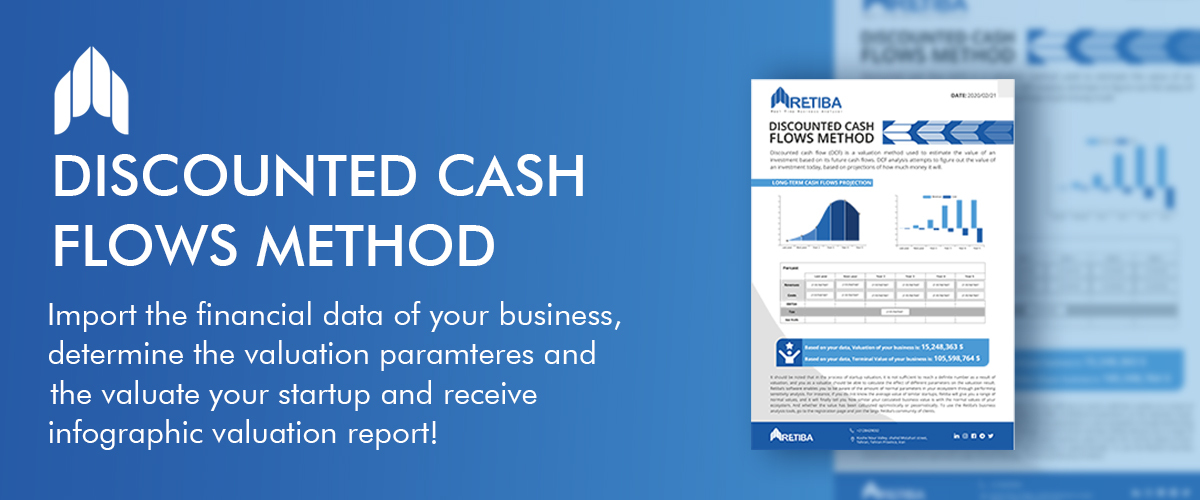

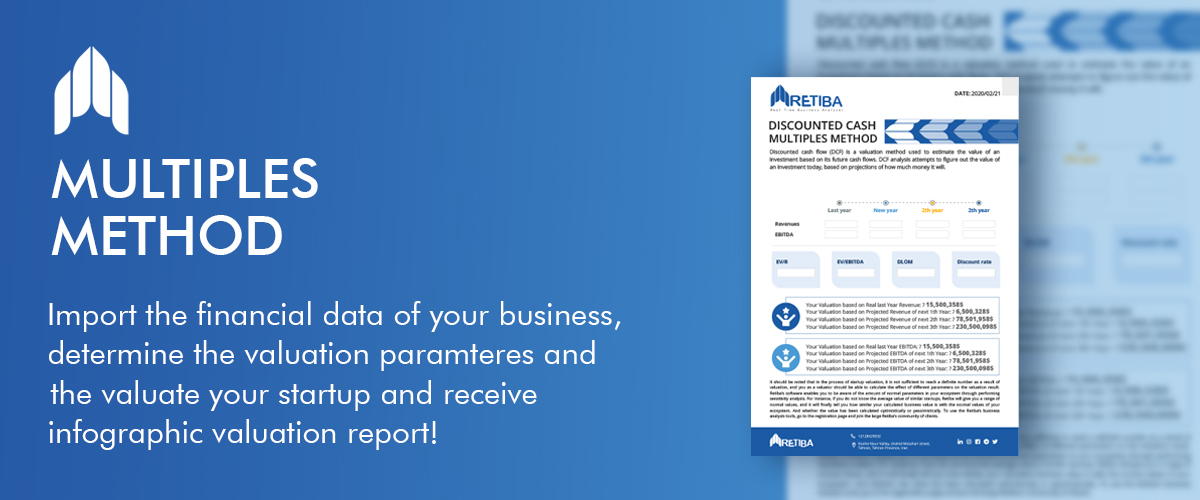

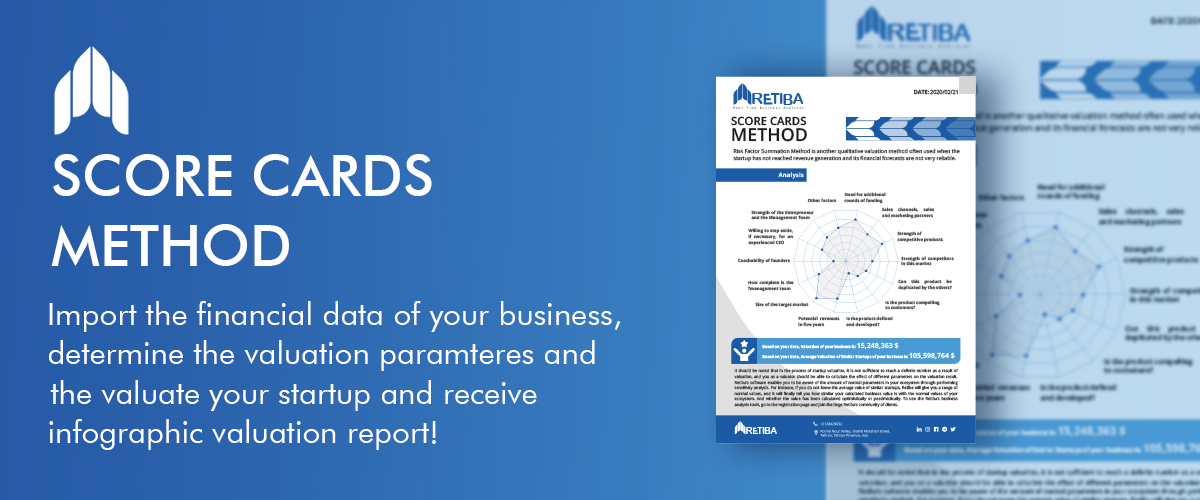

Crowdfunding requires a lot of energy and time and your full commitment. Even this seemingly simple method of raising capital must be accompanied by various calculations. In this way, the company’s path can always be monitored and decisions can be made correctly. One of the best metrics for determining a company’s financial situation and growth is its valuation. Startups don’t have a lot of track records, but they need to anticipate the exact future so that they can make decisions about their current situation. Valuation is one of the services of Retiba Company. Depending on your performance to date, assessing the market situation and examine the company’s various indicators, value the company and provide a complete analysis of its financial situation so that the entrepreneur can make timely decisions about the details of their financing method.

What stage is your startup at? Value your startup online with Retiba’s software free of charge.

Your startup has crossed Death Valley, and it has had at least 2 funding rounds? Discounted Cash Flows (DCF)

Your startup has had at least one funding round, you are advised to use Multiples method for valuation.

Your startup is at pre-seed and seed funding rounds, you are advised to use the Score Cards Method, Risk Factors Summation method to value your startup.