In recent years, the speed of blockchain technology penetration in various industries has grown significantly, and Fintech is one of the industries the core of which has changed by blockchain. The advantages of this technology that play a significant role in completing the missing link in the Fintech industry are, for example, distributed ledger technology, transparency, speed of transactions, and the costs of complying with international law, etc. If blockchain is accepted as soon as possible by central banks and other financial institutions, and the investment of venture capitalists in startups in this field increases, it can be said that the size of this market will grow significantly.

Why You Should Choose Retiba’s Product?

What dose Retiba market analysis tool encompass?

What is market research?

Table of Contents

Market / Industry segment of Blockchain in Fintech

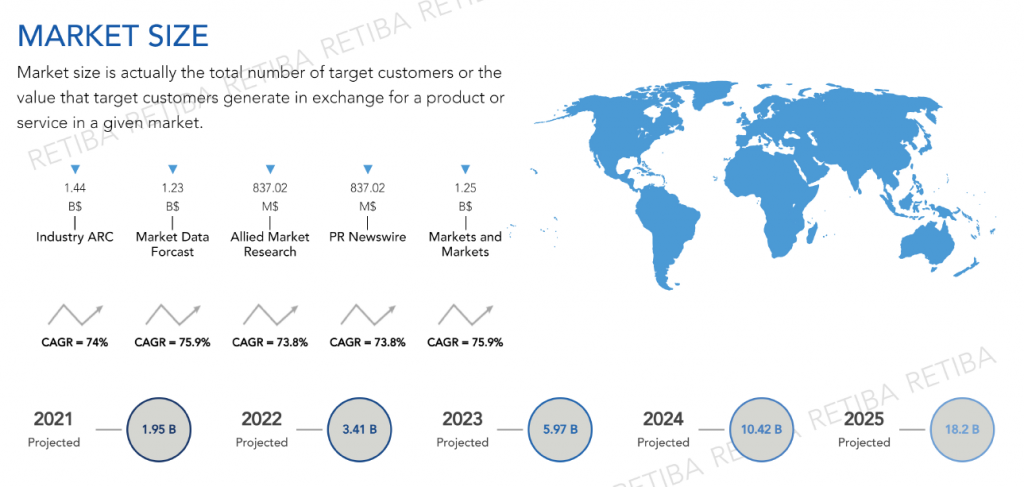

| Base Year | Market size(B$) | Duration(YEAR) | CAGR(%) | Source Name |

| 2018 | 0.02771 | 8 | 73.80% | Allied market research |

| 2018 | 0.02771 | 9 | 73.80% | PR news wire |

| 2020 | 1.44 | 5 | 74.00% | Industryarc |

| 2020 | 1.23 | 5 | 75.90% | Market Data Forcast |

| 2017 | 0.0230 | 6 | 75.90% | Market and market |

Influencing factors that changes market size of Blockchain in Fintech

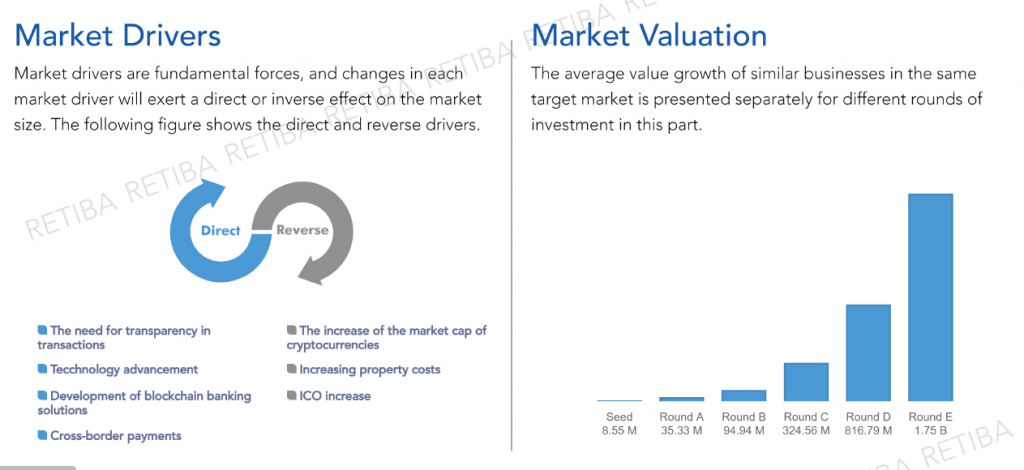

The size of the market value changes under the influence of many factors; the increase and decrease in the rate of these influential factors leads to changes in the value of the market size, which is provided by direct and reverse drivers in the market of Blockchain in Fintech (BFSI)

Direct drivers:

- The need for transparency in transactions

- Technology advancement

- Development of blockchain banking solutions

- Cross-border payments

Reverse drivers:

- The increase of the market cap of cryptocurrencies

- ICO increase

- Increasing property costs

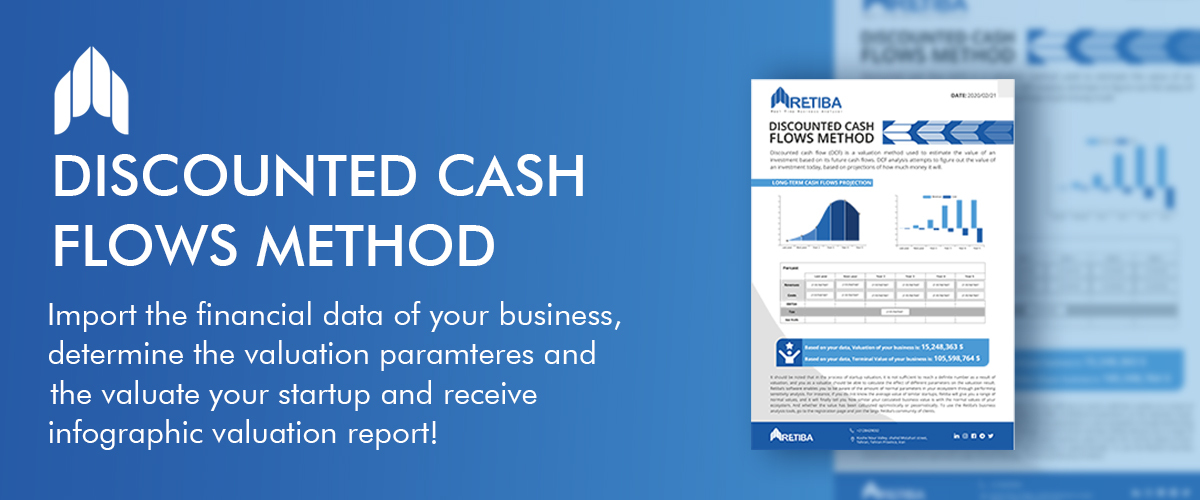

Your startup has crossed Death Valley, and it has had at least 2 funding rounds? Discounted Cash Flows (DCF)

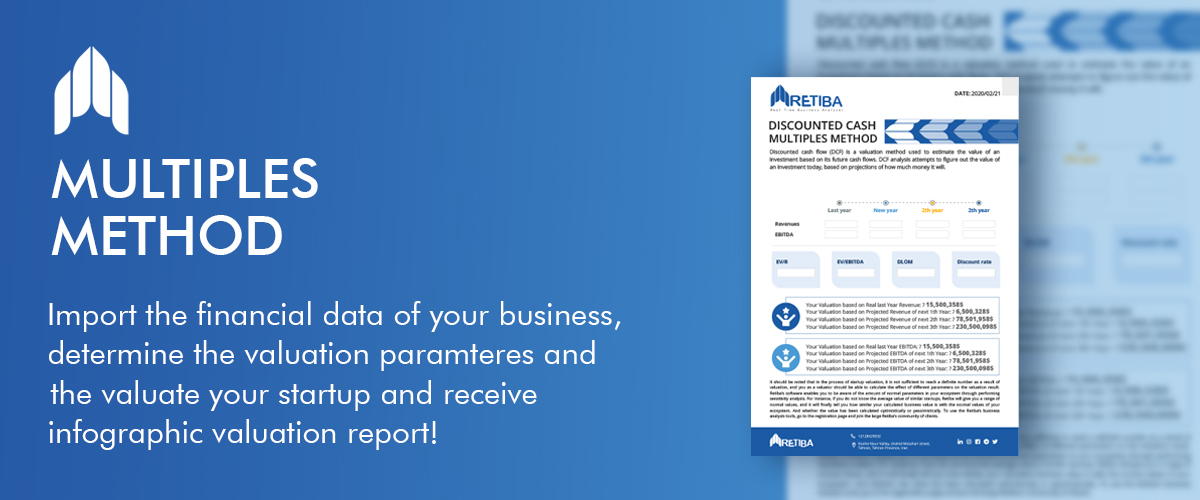

Your startup has had at least one funding round, you are advised to use Multiples method for valuation.

Your startup is at pre-seed and seed funding rounds, you are advised to use the Score Cards Method, Risk Factors Summation method to value your startup.

This market may also be threatened by following risks:

In all different markets and industries, risk is always one of the factors that business founders should be sufficiently aware of. The first step is risk assessment is identification of risks in the market in order to perform risk management. The market of Blockchain in Fintech (BFSI) may also be threatened by following risks:

- Technology risk

- Legislation risk

- Stage of business

- Funding risk

- Exit value risk

- Competition risk