The concept of Crowdfunding allows individuals with their micro-ventures to participate in investments that could not be made with their own money. This concept is now used in many charities, idea and startup financing projects. Due to social communications in most of social networks, crowdfunding has been possible for real estate investors as well in recent years, which is very similar to investment in the capital market.

Table of Contents

Market / Industry segment of crowdfunding

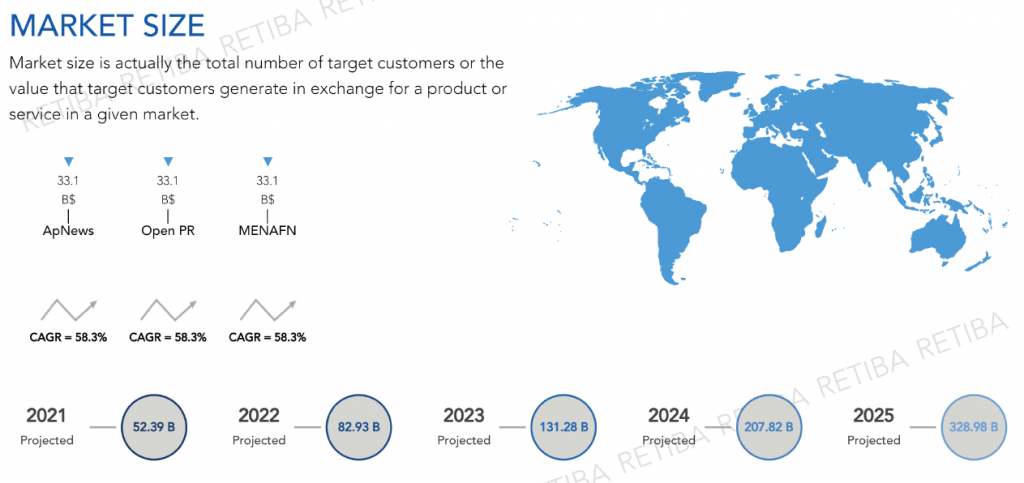

| Base Year | Market size(B$) | Duration(YEAR) | CAGR(%) | Source Name |

| 2018 | 13.207 | 9 | 58.30% | Apnews |

| 2018 | 13.207 | 9 | 58.30% | Openpr |

| 2018 | 13.207 | 9 | 58.30% | Menafn |

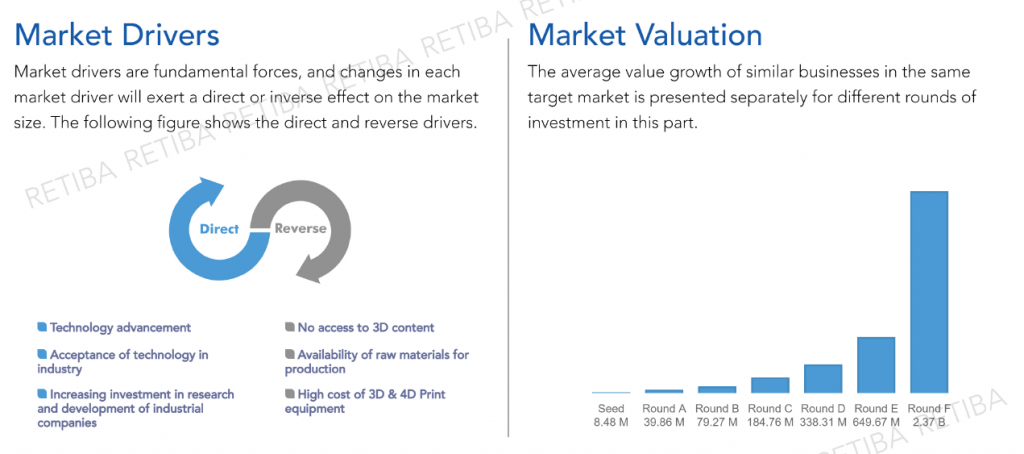

Influencing factors that changes market size of crowdfunding

The size of the market value changes under the influence of many factors; the increase and decrease in the rate of these influential factors leads to changes in the value of the market size, which is provided by direct and reverse drivers in the market of crowdfunding

Direct drivers:

- Increasing the population of Generation Z and Millennials

- Internet and mobile penetration

- Increasing acceptance of P2P model for financing

- Influence of blockchain technology

Reverse drivers:

- Lack of knowledge about blockchain technology

- Lack of trust in crowdfunding platforms

Your startup has crossed Death Valley, and it has had at least 2 funding rounds? Discounted Cash Flows (DCF)

Your startup has had at least one funding round, you are advised to use Multiples method for valuation.

Your startup is at pre-seed and seed funding rounds, you are advised to use the Score Cards Method, Risk Factors Summation method to value your startup.

This market may also be threatened by following risks:

In all different markets and industries, risk is always one of the factors that business founders should be sufficiently aware of. The first step is risk assessment is identification of risks in the market in order to perform risk management. The market of crowdfunding may also be threatened by following risks:

- Stage of business

- Sales and marketing risk

- Technology risk

- Litigation risk

- Legislation risk