In recent decades, the Internet has spread around the world. Naturally, the banking industry has also changed as a result of this pervasiveness. To access a bank account at any time and any place, mobile applications (mobile banks) are designed so that a person can easily do their financial transactions and control their bank account. This issue has many benefits: saving time, reducing operational costs and acceleration of transactions, etc.

If you are interested in having more information on the market maps published in other fields, you can read ” What is market research? “ In this article, we have compiled all the market maps published in Retiba.

Table of Contents

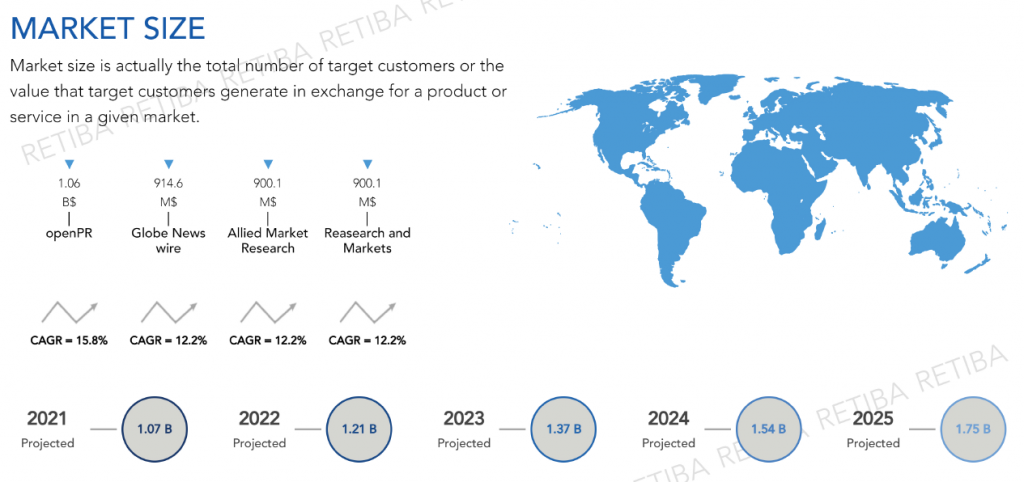

Market / Industry segment of mobile banking

| Base Year | Market size(B$) | Duration(YEAR) | CAGR(%) | Source Name |

| 2018 | 0.715 | 8 | 12.20% | Allied market research |

| 2020 | 1.06 | 10 | 15.80% | Openpr |

| 2018 | 0.715 | 8 | 12.20% | Research and market |

| 2019 | 0.8151 | 7 | 12.20% | Globe news wire |

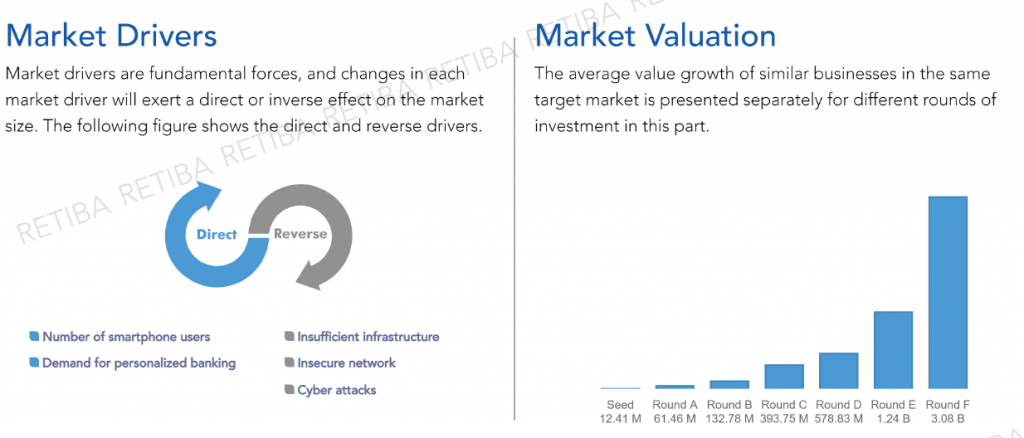

Influencing factors that changes market size of mobile banking

The size of the market value changes under the influence of many factors; the increase and decrease in the rate of these influential factors leads to changes in the value of the market size, which is provided by direct and reverse drivers in the market of the mobile banking

Direct drivers:

- Demand for personalized banking

- Number of smartphone users

Reverse drivers:

- Insecure network

- Cyber attacks

- Insufficient infrastructure

This market may also be threatened by following risks:

In all different markets and industries, the risk is always one of the factors that business founders should be sufficiently aware of. The first step is risk assessment is the identification of risks in the market in order to perform risk management. The market of mobile banking may also be threatened by the following risks:

- Technology risk

- Litigation risk

- International risk

- Reputation risk

- Competition risk

Download market of mobile banking (2020-2025) :