These days, startup fame is accepted all over the world. Many people who are far from entrepreneurship context may think that it is not difficult to have a successful startup. In reality, however, the risks startups may encounter are so great that only smart and genius managers can cope with them. If you are one of the business owners or you are planning to launch a startup soon, you should take the risks of startups seriously and do not try to make them acute by ignorance. Each of these risks can easily make your startup shut down. In this article, we are going to look at the different risks that a startup faces at different stages of its life.

Why You Should Choose Retiba’s Product?

Table of Contents

6 main startup risks

Because a startup deals with different areas of business and different people, the range of risks it faces is extensive. Here are some of the most important risks a startup faces.

1- legal risks in startup risks

Legal risks are one of the most important risks startups may encounter because they cover a wide range of risks and involve a variety of people. For example, the risks related to stock split, employee- contracts, and insurance-related risks are just some of them. A startup may sometimes run into legal problems with large institutions such as the government in the face of a legal risk. Even registering an idea and brand can cause legal problems for a startup.

To address this type of risk, you must either hire a legal expert in your startup or outsource your legal issues to law firms. The legal expert who works with your startup should repeat the process of legal assessment of the startup frequently to avoid legal risks.

2 financial risks

Financial risks include a wide range of risks, all of which have one point in common: financial issues. Risk experts consider financial risks as the most dangerous ones because they may result in the startup closure.

Budget depletion and unavailability of monetary resources to pay employees or produce a product are among the most critical problems a startup can face. Financial analysts need to be able to identify these financial risks before their occurrence due to the fact that it is so complicated to address them and there will be a slim chance for the startup to go on afterwards.

3- management risks

Since the leaders and owners of startups are the masterminds of these start-ups for the market, any startup with a disqualified leader/manager will undoubtedly face serious problems. Startup managers need to be aware of skills including the organization’s human resources management, development, market identification, etc. They must be able to employ their knowledge efficiently. At the first glance, among all the risks startups may encounter, management risks may seem the least important to managers, but the fact is that, in some cases, it is the most important one.

4- development risks in startup risks

Since startups have to offer their product/service on a particular schedule, failure to adhere to this schedule will create development risks. Development risks are the set of risks startups in the face of which the process of product/service development of a startup is disrupted. Managers must anticipate and resolve this problem before it occurs, as development risks will have a negative impact on other different parts of the startup, create other risks and completely disrupt the startup’s planning.

5- design risks

This type of risk comprises a set of risks startups may face in the field of design. In many startups, after the production phase, it is witnessed that the product is significantly different from what the designers intended. This is due to design risks. There are several reasons for this risk; for example, product development team errors or lack of developer experience is one of the main reasons for the occurrence of design risks. Startup technical officials are responsible for identifying and resolving these types of risks before they occur. The design and redevelopment of some products takes so long that repeating them can incur a significant financial and planning shock to the startup.

6- capacity risks

These are the risks in the face of which startups are unable to use their capabilities for unknown reasons. This type of risk also has a huge negative impact on startup planning and may seem insignificant at first glance, but can lead to design and development risks, financial risks, and even management risks. It’s a good idea to take this risk seriously and identify and address it well before you initiate product development processes.

What stage is your startup at? Value your startup online with Retiba’s software free of charge.

- Your startup has crossed Death Valley, and it has had at least 2 funding rounds? Discounted Cash Flows (DCF)

- Your startup has had at least one funding round, you are advised to use Multiples method for valuation.

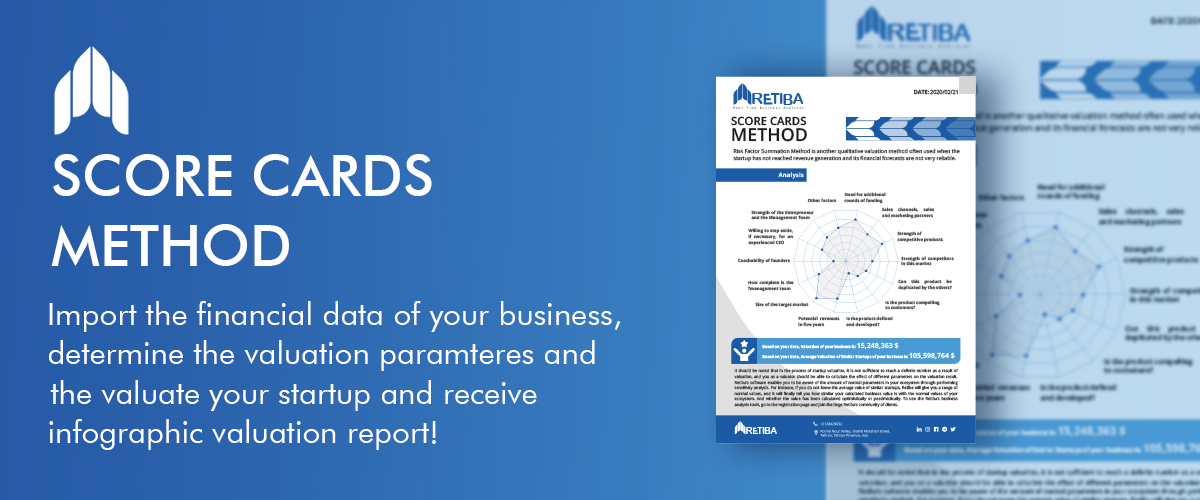

- Your startup is at pre-seed and seed funding rounds, you are advised to use the Score Cards Method, Risk Factors Summation method to value your startup.