Today, one of the most important factors for the success or failure of a business, especially at the beginning of its activity, is its user. And one of the most important key performance indicators related to users is the key performance indicator of Customer Acquisition Cost (CAC). According to studies, startups the second reason for the failure of startups in reaching their target market and product is excessive (higher-than-expected) value of the key performance indicator of Customer Acquisition Cost (CAC).

How to Choose Key Performance Indicators for Our Business?

Table of Contents

What is the key performance indicator of Customer Acquisition Cost (CAC) and how is it calculated?

CAC is calculated according to the following equation which is obtained from dividing the total marketing costs in order to attract customers in a certain period of time to the number of attracted customers in the same period.

Customer Acquisition Cost (CAC) = Total costs related to attracting users / Number of new users

Although the formula for calculating (CAC) is simple, there are important points in its calculation which are discussed below.

Total costs in CAC includes the total cost of marketing, online advertising, websites and even the cost of manpower associated with it. Successful businesses are constantly trying to reduce the amount of key performance indicator of Customer Acquisition Cost (CAC). Although a lot of costs are spent on customer acquisition at the initial stage of each business, the low level of this indicator represents the business health. Of course, in social media businesses, the value of this indicator should be as low as possible, and if the growth is completely viral, Customer Acquisition Cost (CAC) will be very small.

In examining the key performance indicator of Customer Acquisition Cost (CAC), users is important, which is explained below.

The distinction between organic and non-organic

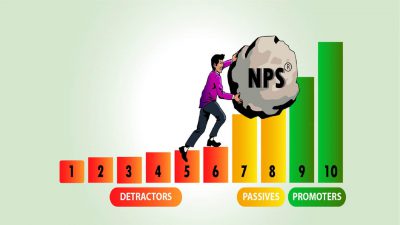

Customer acquisition is both organic and non-organic. An organic user is a user who is attracted naturally and without spending much money. The organic user rate is 50% in businesses reached maturity stage. Some of the organic methods leading to customer growth are word of mouth marketing, effective public relations and also search engine optimization. Since CAC represents the amount of cost paid for attracting each customer, only customers attracted from payable channels and media should be considered. As mentioned earlier, the downward trend of this indicator reveals the health of the business, and if this indicator has a steady upward trend per customer, it indicates that the business will not grow organically, and its growth is solely due to advertising and marketing costs. In this case, the startup must make some modifications to reduce the KPI of Customer Acquisition Cost (CAC).

CAC is used to compare customer acquisition channels and calculate the amount of customer acquisition cost per customer for each channel separately. Moreover, one of the effective ways to increase profits is to reduce Customer Acquisition Cost (CAC).

What are the KPIs related to Customer Lifetime Value?

Although it is necessary to calculate the key performance indicator of Customer Acquisition Cost (CAC) as one of the most important user-related key performance indicators, it is more valuable when combined with other key performance indicators such as Customer Lifetime Value and Average Order Value to get a more accurate analysis of the business situation. For example, if the key performance indicator of Customer Acquisition Cost (CAC) is $ 15 per customer and the Average Order Value is $ 12, it indicates a fundamental problem in the business, but if the Average Order Value is $ 50, the startup is in a good condition.

The Analysis of the ratio of Customer Lifetime Value to Cost of Acquisition per Customer (LTV: CAC)

As previously stated, KPI of Customer Lifetime Value is another key performance indicator that is investigated together with the KPI of Customer Acquisition Cost. One of the most important ratios in this regard is the ratio of Customer Lifetime Value to Cost of Acquisition per Customer (LTV: CAC); ideally, this ratio is 3 to 1 meaning that the value created by the customer in his lifetime must be three times greater than the value invested in his acquisition.. If the value of this ration is q, it means that the business is spending too much on Cost of Acquisition per Customer.

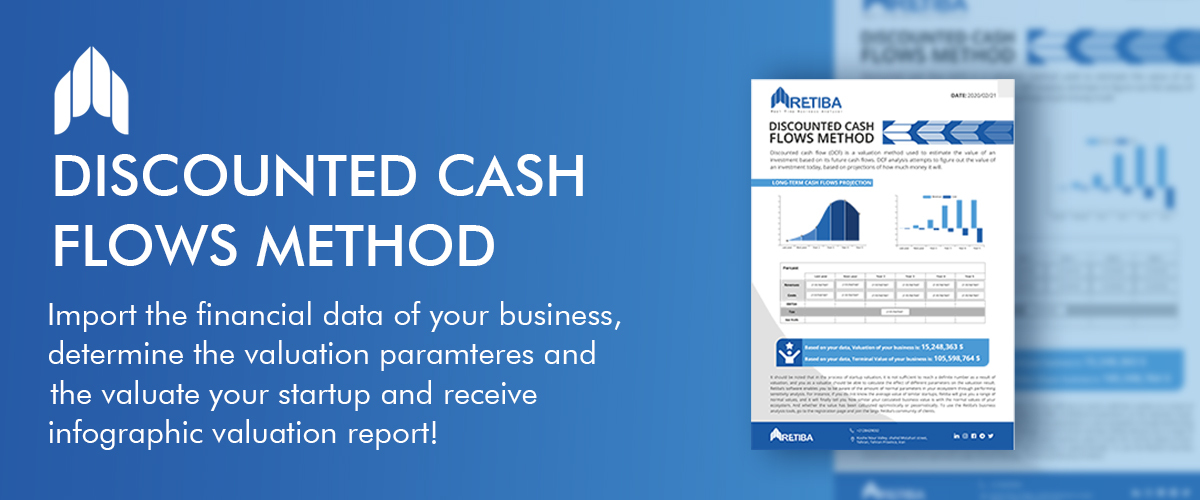

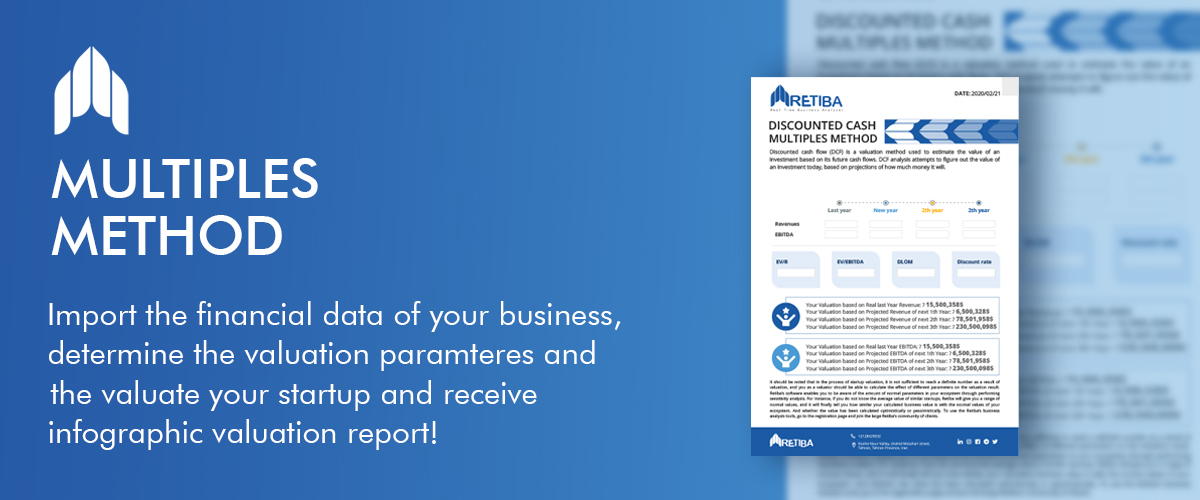

It should be noted that the selection of key performance indicators for a business is influenced by the maturity level of the business, the market in which it operates, the competitive environment and many other factors that require sufficient knowledge and experience. Retiba’s experts are ready to carefully evaluate your startup business model, select key performance indicators, and analyze your business performance. All you have to do is enter your information in the evaluation application form and wait for Retiba’s experts to contact you.

What is Retiba’s services? you can see them in this Link: