Discounted Cash Flows

Discounted cash flow (DCF) is a valuation method used to estimate the value of an investment based on its future cash flows. DCF analysis attempts to figure out the value of an investment today, based on projections of how much money it will.

Three steps in startup valuation with Discounted Cash Flows

STEP 1

Import your historical financial numbers and your projection for 3 to 5 years later. Then, regarding to your market, import the tax rate for your business.

STEP 2

Based on the information you have about market, determine the growth rate and discount rate.

STEP 3

Click on the “Calculate” button and after observing the estimated value of your business, check the graphs provided by Retiba.

Discounted Cash Flow Method (DCF), Is one of quantitative ways of startup valuation whose philosophy and perspective toward valuation is envisioning the future. As mentioned, one of the factors that startups use in formulating their strategy is growth forecasting and consequently business financial projection. Based on the current situation, the fund they have raised or will raise, try to predict future growth and estimate the startup’s revenues. In addition, the costs required to realize the mentioned revenues are examined in the financial projection file, and finally, according to the estimated costs and revenues, the free cash flow of the business is calculated. Since the presented numbers are very uncertain and at risk, projection of more than five years are less recommended.

Unlike market-based methods, qualitative methods and relative methods of startup valuation, The focus of DCF method is only on the future of the business and the vision that the future cash flows of the business are depicted. In fact, Discounted Cash Flow method considers the startup value to be equal to the present value of the cash flows that it will generate in the coming years.

Since the financial projection file is often written without considering the required fund, the calculated value in Discounted Cash Flow method will be the pre-money value. In other words, the financial projection file tries to determine the status of its business in terms of cash inflows and outflows, taking into account all expenses and revenues in the coming years, and determine negative cash flow in different time periods, and collect startup capital accordingly. It is clear that in such a case, the result of startup valuation by DCF method, due to the fact that it is based on financial projection without considering fundraising, express the pre-money value.

Click to submit your rating request: startup valuation

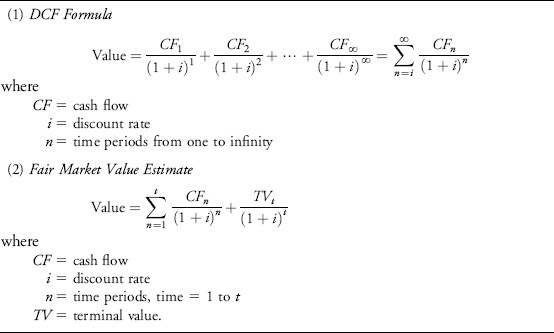

Valuation of startups by Discounted Cash Flow method (DCF) has a basic equation which is as follows:

If the assumptions are carefully considered, in comparison to other methods of startup valuation, DCF is the most accurate way to determine the startup value. Another advantage of this method is that it takes into account a lot of insider information and various factors of a startup in calculating its value. However, it should be noted that the application of DCF requires access to the startup’s historical data to increase the accuracy of its financial forecasts.

It should be noted that in the process of startup valuation, it is not sufficient to reach a definite number as a result of valuation, and you as a valuator should be able to calculate the effect of different parameters on the valuation result.