Valuation or determining the value of a company’s stock is one of the most challenging issues that most investors and startup founders face in the process of fundraising is. In the following article, we intend to examine this concept and elaborate on the appropriate and common methods of startup valuation.

Table of Contents

What is the purpose of startup valuation?

Startup valuation can be done for various reasons, the most important of which are:

Capital Increase: As you know, startups are constantly developing their products and markets at different stages of their lifespans; therefore, they have a negative cash flow for most of their lives. Fundraising is one way to compensate for the negative cash flow of start-ups. In such a case, both the startup founders and the venture capitalists in other words, both parties to the negotiation need to know that the required capital of the business is equal to what percentage of the company’s shares, this evaluation is done through the startup valuation.

- Employee Stock Ownership Plan (ESOP): There is no doubt that good ideas will not succeed in large markets unless a professional and motivated team focus on them. Finding the right people for the various key positions of a startup is not possible only with high salary offers and it may not motivate the managers. This is why most businesses always have a percentage of their stock to hand over to their C-levels to form a long-term relationship accordingly. In such a case, it is necessary for the founders to know the stock value of the company, design a proposal for their managers and staff, and this can only be done by startup valuation.

- A Shareholder’s Exit : Startup shareholders may, for a variety of reasons, decide to exit the company and sell their stocks. Sometimes, the partnership between the shareholder who sells his equity and other business shareholders may be deadlocked, sometimes the venture capital fund may have expired and the shareholder may be forced to sell its assets,. or any other reason may make him to do so. In such a case, startup valuation is important and it is necessary that these calculations are done and the value of the company’s equity is calculated accurately. It should be noted, however, that in general, the value of a equity calculated in a startup valuation is different from the value on which the company’s stocks are sold.

- Merger and Acquisition (M&A): mergers and acquisitions (M&A) is one of the windows for exiting the cap-table of a startup. In any model of agreement, i.e. full acquisition of a startup by another business or merger of both brands in the form of stock exchange or cash exchange etc., the startup must be valued and the stock value of one or both companies should be calculated and the merger and acquisition agreement should be designed and finalized accordingly.

- Initial Public Offering (IPO): The most important exit window that startups have been looking at, is IPO. In such a case, obviously, it is necessary that the business is valued and the value of each share of the company is accurately calculated and based on the initial public offering of shares takes place accordingly.

In short, it can be stated that startup valuation plays a key role in all financial events a business encounters, and it is necessary to calculate the value of the company’s equity accurately.

What kind of value is calculated in startup valuation process?

Before examining the common methods of startup valuation, it is necessary to consider what kind of value will be ultimately calculated in the valuation process. In financial analysis, different types of “value” are calculated, the most important of which are:

What is calculated in the startup valuation process is the intrinsic value of the business, which may not be equal to its market value or market fair value. Calculating the intrinsic value of businesses can be done in different ways, some of which will be introduced below.

- Intrinsic Value which is obtained from fundamental analyses of the business and is the value of all tangible and intangible assets.

- Economy Value which is obtained from the normal amounts of economic size and is the maximum price for which the investor is willing to pay.

- Market Value which is obtained from the conventional values of the market and is the price that is determined in the market based on the amount of supply and demand.

- Market Fair Value which is obtained from conventional values and the results of market research and is a fair price from the perspective of market activists that is agreed upon by the seller and the buyer.

What are the different methods of startup valuation?

Startup valuation requires financial experience and knowledge, and according to the available data, business maturity stage and many other parameters valuation method should be selected and a valuation process should be initiated.

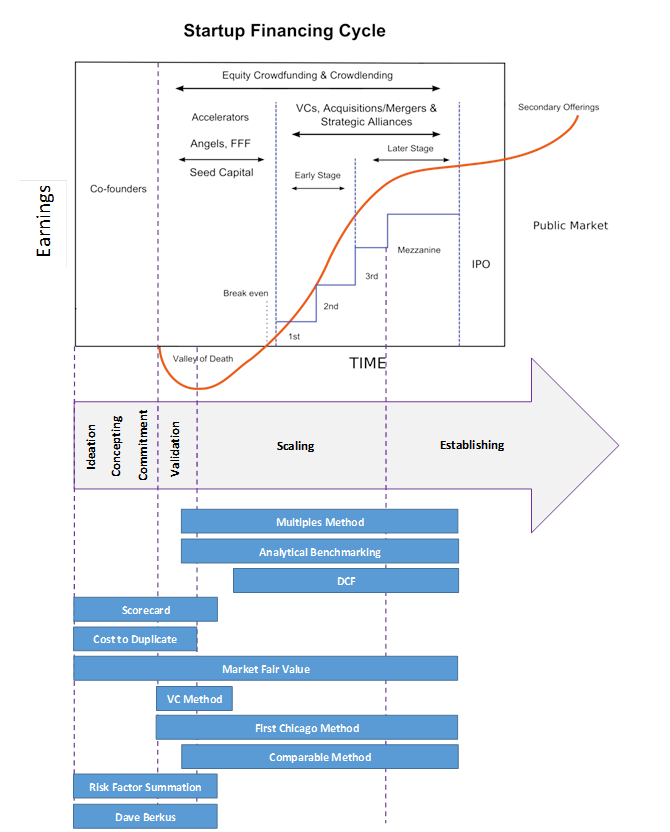

In general, startup valuation methods can be divided into three categories: qualitative startup valuation methods, relative and market-based methods, and methods based on business financial data.

Qualitative methods of startup valuation: These methods are often used in the early stages of startup maturity. As mentioned earlier, in the early stages, startups often lack historical financial data and sales KPI and are busy with the product-market fit process. On the other hand, startups are not mature enough to estimate their value by comparison with other startups. Therefore, startup valuation in the early stages is often done qualitatively by quantifying some quality indicators in order to estimate the approximate value of the business with acceptable accuracy. Some of the most important qualitative methods of startup valuation are:

Startup valuation using Score Cards Method:

Startup valuation using Dave Berkus method: Dave Berkus proposed this innovative startup valuation method for the first time in Winning Angels and used a combination of several key business performance indicators. Berkus’s valuation method is based on the principle that the valuer has accepted that the income or business under his control will reach about $ 20 million over the next five years. In this case, the pre-money value to the start will be at best $ 2.5 million. This figure comes from five key business performance indicators, each of which is equivalent to $ 500,000. In other words, if the startup under review, has realized none of these key performance indicators, its corresponding value is zero and if it has achieved all five cases, the limit value, i.e. two and a half million dollars will be assigned. These indicators include:

- Innovative and scalable ideas

- Ready MVP or the minimum viable product

- Full-time entrepreneurial team focused on product development

- Existence of strategic partners for rapid business development

- Identification of sales channels and receiving initial feedback from current customers

It is clear that the financial forecasts of future business conditions, the financial ratios of similar startups are not considered in Berkus’s method of startup valuation. In fact, this is a rapid and approximate way of valuation. The valuer’s experience is really highlighted here, and the likelihood of being erroneous will be, of course, high. It is recommended that Berkus Method be applied accompanied by other valuation methods.

Startup Valuation by Risk Factor Summation Method

Risk Factor Summation Method is another qualitative method of startup valuation that is often used when the startup is not profitable and its financial forecasts are not very reliable. Risk Factor Summation Method provides you with the pre-money valuation, and its philosophy and view of valuation in such a way that according to its knowledge of the market, quantifies the risks the business encounters and considers the effect of the sum of these risks on pre-money valuation. Thus, the more adverse the risks to the business, the lower the value of the startup, and the more opportunities these risks bring about for the startup, the greater its value.

Considering the risks which a business encounters depends on the startup’s field of activity, its maturity level, and other conditions that the valuer has considered, and there is no specific questionnaire like Score Cards Method, for Risk Factor Summation Method. Sometimes, due to the nature of the business, the operational (management) risk of the business is highlighted and the valuer considers different aspects to improve it, and sometimes it is possible that the environmental risks are further evaluated by the valuer.

The Risk Factor Summation Method is carried out based on the comparison and experience. That’s why this method is applied to value pre-revenue startups that are in the early stages.

The main advantage of the Risk Factor Summation Method is taking into account the critical risks of business in determining the value of a startup. For this reason, it is always recommended to the investor to apply this method at early stages. However, it should be noted that the dependence of this method on the perception of the valuation team would decrease its accuracy.

But in general, the most important risk sources and factors for startups can be divided into 12 categories:

To examine the managerial risks, one should pay more attention to the personality and morale of the startup founder as well as those of the business management team. The more relevant work experience, consulting spirit, team empathy, technical capability in the team, the lower the management risk and the startup will earn more scores in this section

The earlier a startup is in its maturity cycle, the more likely it is to fail, and naturally investing in it will bring about more risk to the investor.

Various legislation and political factors such as labor and trade laws, tax policies, changes in tariffs, regulations related to business licenses, etc. can affect the success or failure of a business. It is a valuer’s art to examine the status of a startup, considering the target market, legislation, and political risks of the business, and to correctly consider the high or low risk for that part in the startup valuation process quantitatively.

Making a product by the startup team requires the assurance of all parts of the supply chain of the product, and the high supply risk of a supply chain part can jeopardize the entire production process.

The more the offered product or service matches the customers’ needs, the risk of selling and marketing the product is reduced and the startup will earn more points in this area. In addition, the following can be considered in minimizing the risk of sales and marketing and rating the startup: accurate and comprehensive market research, the attractive market size for the investor, coherent marketing plan, selection of correct marketing and sales channels, and strong business partners.

Another consideration for a venture capitalist is the risks associated with raising capital at a later stage. Are there other investors in the next stages who will invest in this project and help the business grow exponentially? Is business growth exponential and scalable? Does a startup have the potential for a profitable exit? Does investing in this project bring about the desired return for the venture capitalist?

To examine competitive risk, as its name implies, it is necessary to investigate these points: the intensity of the competitiveness of the business environment; how many direct and indirect competitors does the startup have in its target market, what is the market share of competitors, how likely is it for the project to create a new market or gain a share of its competitors in the same market, how likely it is that competitors will enter the field in the future and make things difficult for this team.

Investigating technology risks requires ensuring that the necessary infrastructure for the technology is available. The following points are considered: the extent to which the use of the aforementioned technology is consistent with the behavior of customers in the target market, the extent to which the hardware infrastructure in the target market allows customers to use the technology, and of course, how the emergence of newer technologies in the future can cause a complete business failure.

In assessing the litigation risk of a startup, the valuer should consider that due to the startup’s nature, how likely is it to stop its activities or be involved in a legal case because of a complaint from a natural or juridical person despite having the necessary licenses.

Sometimes, international factors can increase or decrease a business risk; factors such as international sanctions, exchange rate fluctuations, and good relations between countries leading to the entry of foreign investors. The better the international relations of the country in which the startup operates, the more stable the startup market, and naturally the possibility of business development increases; consequently, the probability of failure decreases.

Although reputation is always a positive issue related to a business, it should be noted that it also encompasses some risks. Increasing the reputation and awareness of a startup brand will cause the behavior of business managers, employees, and everything related to that startup to be magnified, and a small mistake will inflict irreparable harm to the brand’s reputation.

Taking a glance at the startup’s target market, the technical, legal, and technological infrastructures, and of course, the business idea can help the valuer to estimate how profitable the business idea is potential. In this way, reviewing successful foreign instances (if any) of product, compatibility with customer needs, etc. can help the valuer to assess potential profitability risk.

Similar to Score Cards and Dave Berkus methods, the Risk Factor Summation Method is carried out based on comparison and experience. That’s why this method is applied to value pre-revenue startups that are in the early stages.

The main advantage of the Risk Factor Summation Method is taking into account the critical risks of business in determining the value of a startup. For this reason, it is always recommended to the investor to apply this method at early stages. However, it should be noted that the dependence of this method on the perception of the valuation team would decrease its accuracy.

Relative and market-based methods of startup valuation

Another category of startup valuation methods is the valuation of startups based on the conventional market values and financial ratios. In fact, these methods assume that businesses in similar markets behave similarly, and if they have reached relative maturity, their financial ratios can be considered similar, too. Some of the most important of these methods are:

Startup valuation using Market Fair Value Method

Suppose you decide to buy a house in one of the areas of your city. What do you do to find out about prices in that area? You will probably go to online and offline advertisements and take a look at the prices of advertised housings in that area. If you have more contacts, you will ask the residents of that neighborhood about the price of different houses and you will get the price range of the neighborhood. If you want to get more “real” prices, you should go to the real estate agencies and find out about the latest “real” property deals in the area.

The fact is that the Market Fair Value Method works in the same way. If the buyer of the property is assumed as an investor and the house as a startup, of course, when an investor wants to invest in a startup in a specific industry with a specific target market, it is similar to the situation where someone wants to buy a house. Just as in such cases, the buyer of the property (house) does not run the calculations, and he does not calculate the fine value of the materials used in the property; similarly, the investor avoids these issues and only assumes an approximate price for the startup in X field, in Y round, and if he wants to be a little more flexible, he sets a price range. For example, based on the results of this valuation method, the investor will conclude that startups in the field of financial technologies (Fintech) in the first round of fundraising are traded and valued 10-15 million dollars if they are active in country A and their target market is the same country A.

In fact, it can be said that the market fair value method tries to provide a certain value for the startup under consideration at different rounds of fundraising, considering its business field, market size and, of course, real deals made between similar startups and venture capitalists. However, this can only be done easily when the startup ecosystem is so mature and developed that sufficient disclosed valuation data and fundraising deals between the startup and the investor are available.

Startup valuation by Analytical Bench-Marking Method

Analytical Bench-Marking Method is a relative method of startup valuation that can be considered similar to the Market Fair Value method or even the Comparative Method. In this valuation method, without having the values of revenues and costs of the startup understudy, valuation is done with the help of economic, political, or technological adjustment ratios only by looking at the valuations made on similar domestic or foreign startups. Although this valuation method is as challenging as other relative methods, the positive point is that it can be used at all stages of the business life cycle and can assess the value of similar startups operating in the ecosystem when we face data constraints.

If we tried to find a startup similar to the startup under consideration in our business ecosystem and estimate the value of the startup using its disclosed valuation data in the market fair value method, there is no need to find a startup in our own startup ecosystem in Analytical Bench-Marking Method. In this case, first, we find successful startups whose business model is similar to the startup business model under consideration, collect key information such as target market size, startup value, amount of raised funds, business life, etc. and enter the valuation process. Second, it is enough to extract the same information for the startup under investigation from reliable sources and, as the Comparative Method, to estimate the value of the startup with the help of a series of ratios

Some of these key parameters are:

- Target market size

- GDP per capita (PPP)

- Internet penetration rate

- Online shopping rates

- population

- Global Innovation Index

- And other factors

Once each of these key parameters has been calculated for the target markets of the origin and destination countries, depending on the scope of the startup under evaluation, it is sufficient to divide the parameter of the country of origin into the corresponding parameter in the destination country; In this case, you have calculated the adjustment ratio for that parameter. Now it’s time to weigh each of these parameters. It should be noted that, for example, in valuing an online taxi startup, the weight of the adjustment ratio related to the size of the target market should be considered more than the weight of the adjustment coefficient related to the global innovation index.

In Analytical Bench-Marking Method, if it is possible to find a startup similar to the original startup, an estimation of the startup value can be quickly achieved by multiplying some ratios. Therefore, this method is less troublesome and it is a fast way to value startup in the middle and final stages. However, it should be noted that finding a similar startup whose valuation information is available is difficult.

On the other hand, as we increase the number of adjustment ratios, it is not possible to adjust all the conditions and aspects of the original and benchmark startup. Consequently, Analytical Bench-Marking Method is commonly used to assess the accuracy of the results obtained from other startup valuation methods.

Startup Valuation Methods: A Comparative Method

Startup valuation, due to its nature and computational basis, is always a challenge not only between startups and investors but also between different values. The comparative valuation method, as one of the relative methods of startup valuation, exacerbates this challenge because of its view of startup valuation. The computational basis of this method is to assume that we decide to value a startup in a completely estimative way, without wanting to enter into valuation calculations such as Discounted Cash Flow. We know the startup competitors in the same field and target market, and we happen to know that according to the leaked news, what the value of the competing startup was and the number of some KPIs. In this case, it is enough to use a simple ratio: how much do we value with this number of users and this volume of sales if they have traded so much with this number of users and this volume of sales?!

In fact, it can be summarized that in comparative startup valuation, we have one or more startups similar to the startup understudy in the same field and target market, where valuation information and some KPIs have been disclosed. In this case, it is enough to calculate the value of the startup using a simple ratio. Thus, the value divided by the index for the benchmark startup is equal to the value divided by the index for the valued startup. It should be noted, however, that although the comparative valuation method is a relatively simple method and does not have the complexities of a method such as Discounted Cash Flow; if a poor performance index is used, or a benchmarked startup is significantly different from the startup under review in terms of the target market, maturity, or other issues, the results provided by this method will undoubtedly be significantly different from the reality of the business.

A comparative valuation can be applied for both the early stages of a startup when it has not yet reached revenue generation and the intermediate and final stages when it has reached revenues generation. Due to the fact that a comparison of two similar startups’ indexes is the basis of this method, it is similar to Analytical Bench-Marking Method. The difference between the two methods is the use of international startups and applying adjustment ratios in Analytical Bench-Marking Method. If information about the value of investments and the index of the start of a startup is similar to the Analytical Bench-Marking Method. If the information related to valuation is available, comparative valuation is a quick way to estimate startup valuation.

It should be noted that due to the fact that the value of the comparative valuation method may not be accurate, and it is just used as an index for startup value. It is likely that the benchmarked startup differs from the startup under investigation in terms of business model risk, income model, and other factors. For this reason, it is recommended not to consider only one startup and index and add several adjustment factors related to a number of startups (similar to the Analytical Bench-Marking Method) to increase the valuation accuracy. In general, it can be said that the accuracy of the Comparative Method is low and it is suggested that this method be used in conjunction with other methods of startup valuation.

Startup Valuation by Multiples Method

Multiples Method is another relative Method used to evaluate startups that have reached revenue generation and made a profit. The multiples Method is a simple and fast way to calculate the startup value. If the financial information of the listed companies in the stock exchange, as well as the sales, income, or profit information of the startup, are available, it is possible to obtain the estimated value of the startup by multiplying these values. This method also shows that a startup will eventually achieve value near similar companies that are currently listed on the stock exchange. However, it should be noted that one of the weaknesses of this method is comparing companies with the assumption that they are similar. Active stock exchange companies have generally gone through the growth phase and reached a level of maturity in their business; therefore, the financial and operational structure of these companies is very different from a startup in the growth stage.

The approach of this method is similar to that mentioned in the Comparative Method, that is, by comparing the financial data of startups in similar domains, one can estimate the approximate value of the startup under consideration. In the comparative valuation method, you divide the value of the benchmarked startup in your field of activity by one of the key performance indicators that you have its data, then multiply the result by the corresponding key performance indicator in the startup understudy and gain the startup value. In the Multiples Method, the valuation approach is almost the same. In fact, in the Multiples Method, instead of putting the number of a key performance indicator, you should use a financial index related to that business such as EBITDA.

Another difference between the Comparative Method and Multiples Method is that the disclosed financial data of the listed companies in the stock exchange can be used in Multiples Method. Taking a glance at the stock exchange site, it can be seen that the financial information of many businesses in different fields is presented in a transparent manner such as market value or market cap of the company, a number of shares, value per share, EPS , and P / E ratio, etc. In sum, it can be said that the Multiples Method works in such a way that a number of listed companies whose field of activity is very similar to the field of startup under study, their financial ratios such as EV/R Or EV /EBITDA are calculated, and the value of the parameter in the denominator of this ratio for the startup under review is multiplied by this ratio and the startup value is estimated. Sometimes, the data of the previous year is used, sometimes to provide the valuation results tendency toward the future of the business, the forecasted data of the startup are used; accordingly, at the desired discount rate, the obtained numbers are discounted and the current value of the startup is calculated with the help of future data. Additionally, the Multiples Method applies a coefficient called DLOM in the end which the startup gives to the investor due to the low liquidity of the capital that the venture capitalist has injected into the startup valuation calculations.

As mentioned earlier, as a startup becomes more mature and more established in the market, its associated risks will be less and its financial forecasts will be less uncertain. That is why in most middle and late-stage valuations, one of the quantitative and financial-based methods is used for startup valuation. The most important of these methods are Discounted Cash Flow Method (DCF) & venture capital method.

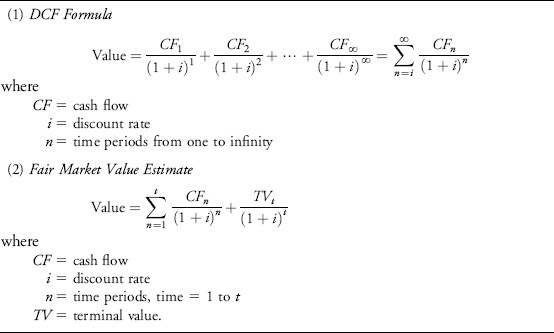

Valuation of startups by Discounted Cash Flow Method (DCF)

Discounted Cash Flow Method (DCF), Is one of the quantitative ways of startup valuation whose philosophy and perspective toward valuation is envisioning the future. As mentioned, one of the factors that startups use in formulating their strategy is growth forecasting and consequently business financial projection. Based on the current situation, the fund they have raised or will raise, try to predict future growth and estimate the startup’s revenues. In addition, the costs required to realize the mentioned revenues are examined in the financial projection file, and finally, according to the estimated costs and revenues, the free cash flow of the business is calculated. Since the presented numbers are very uncertain and at risk, projections of more than five years are less recommended.

Unlike market-based methods, qualitative methods, and relative methods of startup valuation, The focus of the DCF method is only on the future of the business and the vision that the future cash flows of the business are depicted. In fact, Discounted Cash Flow method considers the startup value to be equal to the present value of the cash flows that it will generate in the coming years.

Since the financial projection file is often written without considering the required fund, the calculated value in Discounted Cash Flow method will be the pre-money value. In other words, the financial projection file tries to determine the status of its business in terms of cash inflows and outflows, taking into account all expenses and revenues in the coming years, and determine negative cash flow in different time periods, and collect startup capital accordingly. It is clear that in such a case, the result of startup valuation by DCF method, due to the fact that it is based on financial projection without considering fundraising, expresses the pre-money value.

Valuation of startups by Discounted Cash Flow method (DCF) has a basic equation which is as follows:

If the assumptions are carefully considered, in comparison to other methods of startup valuation, DCF is the most accurate way to determine the startup value. Another advantage of this method is that it takes into account a lot of insider information and various factors of a startup in calculating its value. However, it should be noted that the application of DCF requires access to the startup’s historical data to increase the accuracy of its financial forecasts.

Startup valuation through venture capital method

The venture capital method is one of the startup valuation methods that is often used by venture capitalists to quickly estimate the value of a startup. This method of startup valuation is often used in the early stages when the startup does not have a lot of financial data and in the valley of death, when it is busy adapting its product to the market and trying to move towards its vision. The startup’s vision plays a key role in startup valuation through the venture capital method. In this way, the venture capitalist looks at the future of the startup and the closest businesses that have succeeded in approaching the exit window and predicts the value of the startup under consideration when it will reach its exit window in the distant future. In other words, what a venture capitalist seeks in startup valuation through the venture capital method is the Terminal Value of the startup. To find the terminal value of a startup, one can use the information of stock exchange companies, mergers and acquisitions of similar companies, or the recent initial public offering of similar startups.

The venture capital method is not based on a complex mathematical relationship, the only basic equation in this valuation method is that the terminal value of the startup at the exit time, divided by the current value of the startup equals the investment growth. Of course, it should be noted that this growth in investment does not mean the percentage of growth, it means a multiplication of investment.

But it is worth noting that the valuer seeks to estimate the current value of start-ups under consideration through the venture capital method. For this, it is sufficient to rewrite the equation of venture capital in the form of the terminal value divided by the growth expected by the investor. The expected return of the investor is determined based on the investment horizon, the economic conditions of each country, and the investor’s expectations.

The venture capital valuation method is used for the middle and late stages of startups that are on the verge of monetization or have not been profitable for a long time because we need to estimate the exit value of the startup in this method. Compared to other startup valuation methods, the venture capital method is a simple and fast way to determine the value of the startup. However, it should be noted that startup valuation with the help of the venture capitalist method requires reliance on startup revenue and future growth forecasts. Given the risks involved in startups, it is difficult and erroneous to predict their financial performance in the future. Moreover, determining the expected return of investors is a qualitative matter and there is no quantitative way to calculate it. These two factors make the venture capital valuation method not be an accurate way to calculate the value of a startup.

How to choose the right method for business valuation?

Several criteria can contribute to choosing the right method for startup valuation such as business maturity level, available financial data, startup growth potential, the field of activity, market size, market share, etc. These factors can help the valuer to choose the best way for startup valuation. As shown in the figure below, in various stages of a businesses’ maturity cycle, different calculating methods can have various precision. In the early stages of the maturation cycle of any business, that is the seed stage, the startup valuation methods tend towards qualitative methods, and accordingly, as the business becomes more mature and developed valuation methods are inclined toward quantitative and financial data-based methods.

Conclusion

Various methods and approaches have been proposed to calculate the intrinsic value of businesses, the most important of which are discussed in this article; the point, however, requiring special attention is that in startup valuation, achieving a certain number as a result of the valuation is not sufficient; as a result, a valuer should be able to evaluate the effect of various parameters on the valuation result.

Retiba software provides you with this feature so that while conducting a sensitivity analysis, you could be aware of the value of conventional parameters in your own ecosystem. For example, if you do not know the average valuation of startups similar to yours or what value to consider as the discount rate, Retiba recommends you a range of conventional values, and in the end, it informs you how far the calculated value of your business is from normal values of the ecosystem and whether valuation has been done optimistically or pessimistically.

To use Retiba’s business analysis tools, it is sufficient to go to the registration page and join Retiba’s large community of clients.

4 Comments. Leave new

How can you perform a DCF valuation on a company with negative cash flows?

It is better to use different method for valuation in these sitations. As you know, in DCF method you calculatig present value of future positive cash flows, then if your business doesn’t have any profit in future, it would be meaningless to use discounted cash flows method.

I can’t propose any alternative method for your business without analyzing any data from your side; however it might be usefull if you use Revenue Multiples Method too.

I am interested for start-up

Request for further details

Thank you, Nishant.