Changes in customer behavior and the emergence of disruptive technologies have affected the activities of financial institutions. The lending pattern is one of the services whose new form is very different from the traditional model. The increasing number of mobile phones and the penetration of the Internet, along with the focus of financial institutions on providing advanced services, have influenced the growing trend of the loaning platforms market. In addition to reducing operational risks and minimizing loan costs, these systems also save the time of lenders and borrowers.

If you are interested in having more information on the market maps published in other fields, you can read ” What is market research? “ In this article, we have compiled all the market maps published in Retiba.

Table of Contents

Market / Industry segment of loaning platforms

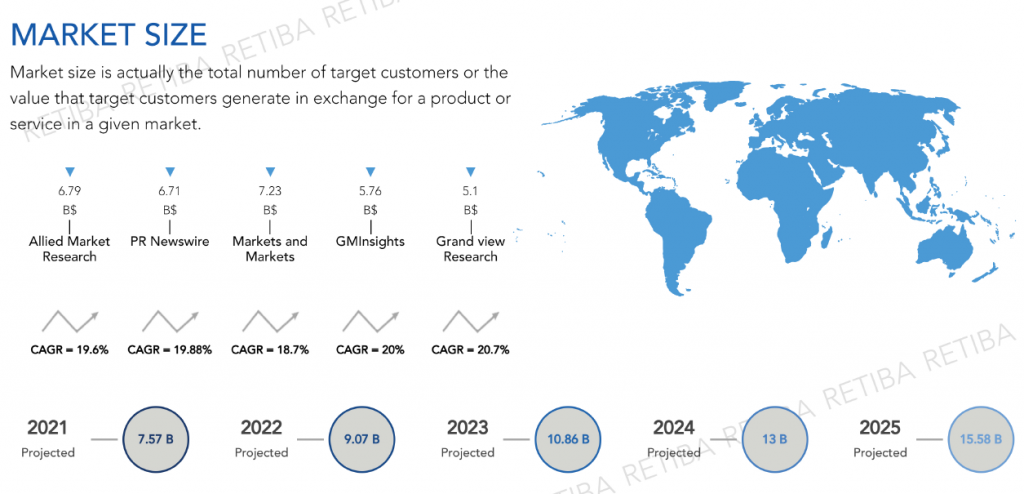

| Base Year | Market size(B$) | Duration(YEAR) | CAGR(%) | Source Name |

| 2018 | 3.5 | 8 | 20.70% | Grand view research |

| 2018 | 4 | 7 | 20.00% | GMInsights |

| 2018 | 5.13 | 5 | 18.70% | Market and market |

| 2019 | 5.6 | 7 | 19.88% | PR news wire |

| 2019 | 5.68 | 7 | 19.60% | Allied market research |

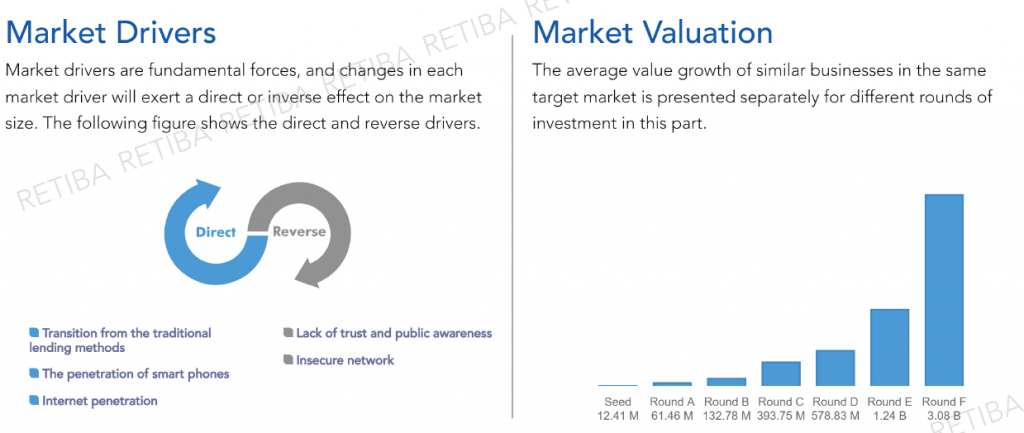

Influencing factors that changes market size of loaning platforms

The size of the market value changes under the influence of many factors; the increase and decrease in the rate of these influential factors leads to changes in the value of the market size, which is provided by direct and reverse drivers in the market of lending and loaning platform

Direct drivers:

- Internet penetration

- The penetration of smart phones

- Transition from the traditional lending methods

Reverse drivers:

- Insecure network

- Lack of trust and public awareness

This market may also be threatened by following risks:

In all different markets and industries, the risk is always one of the factors that business founders should be sufficiently aware of. The first step is risk assessment identifying the market to perform risk management. The market of lending and loaning platforms may also be threatened by the following risks:

- Technology risk

- Reputation risk

- Legislation risk

- Litigation risk

- Competition risk

Download this market map (2020-2025) :