In recent years, the demand for cryptocurrencies has risen sharply due to its acceptance by financial institutions and companies; therefore, crypto asset trading has become more reliable. It seems that venture capital and the use of strong cryptographic techniques in asset management solutions appear to play a significant role in market growth in the coming years although government and legislative interventions may limit this growth.

Why You Should Choose Retiba’s Product?

What dose Retiba market analysis tool encompass?

What is market research?

Table of Contents

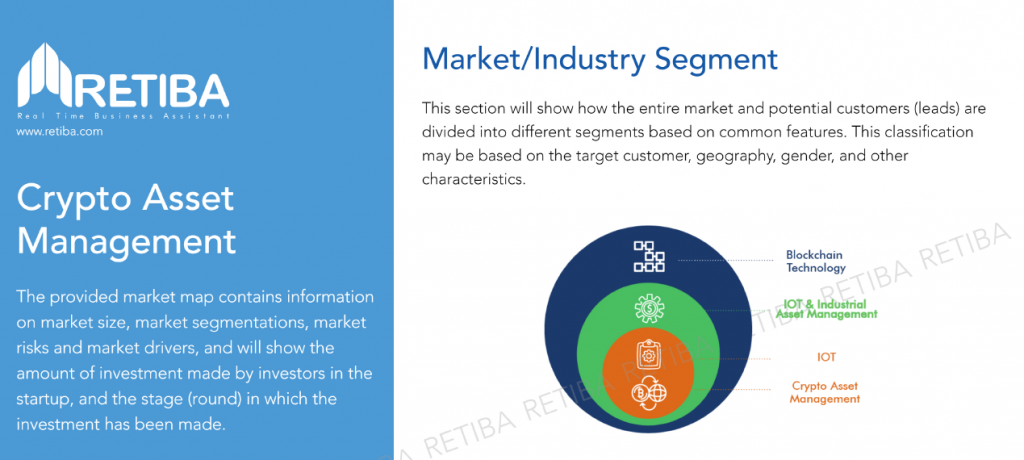

Market / Industry segment of crypto assets management

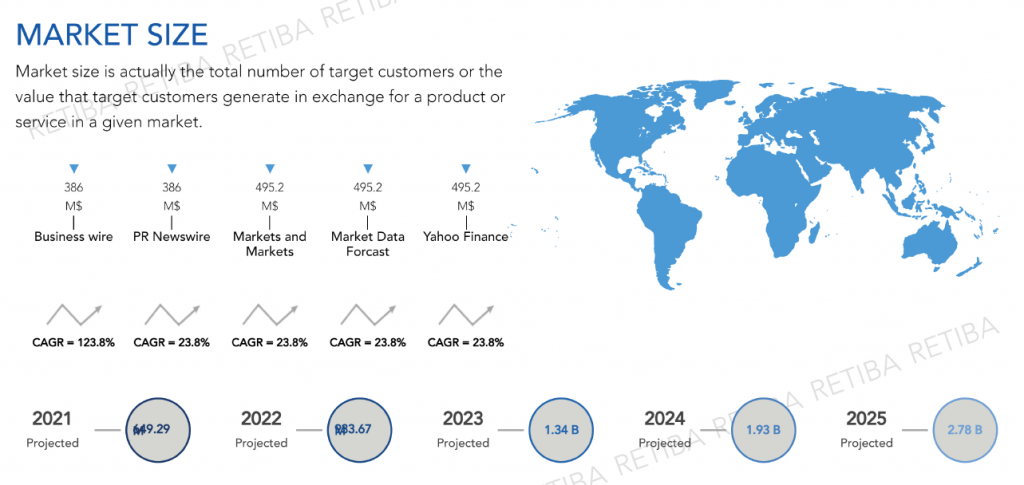

| Base Year | Market size(B$) | Duration(YEAR) | CAGR(%) | Source Name |

| 2019 | 0.754 | 8 | 11.20% | Fotune business insights |

| 2019 | 0.674 | 8 | 32.35% | Verified market research |

| 2019 | 0.674 | 9 | 32.35% | Market research blogs |

| 2019 | 1.03 | 5 | 6.18% | Market and market |

| 2018 | 856.36 | 6 | 11.90% | PR news wire |

Influencing factors that changes market size of crypto assets management

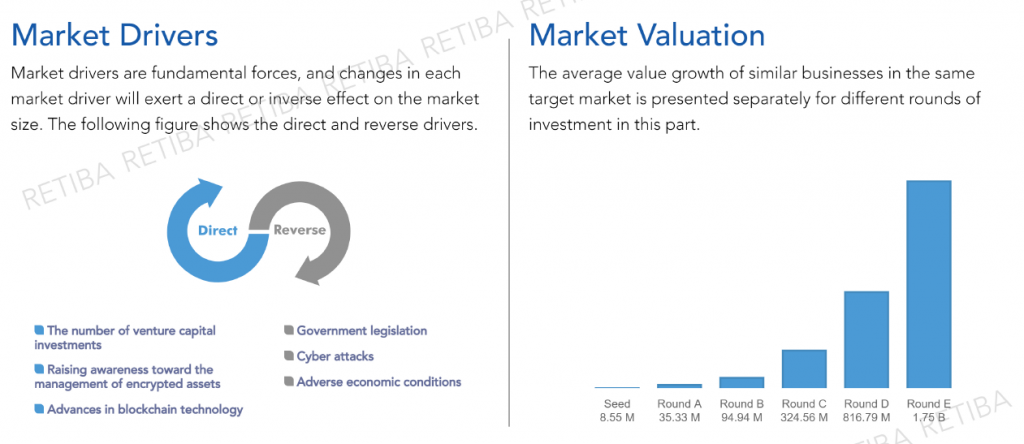

The size of the market value changes under the influence of many factors; the increase and decrease in the rate of these influential factors leads to changes in the value of the market size, which is provided by direct and reverse drivers in the market of crypto assets

Direct drivers:

- The number of venture capital investments

- Raising awareness toward the management of encrypted assets

- Advances in blockchain technology

Reverse drivers:

- Adverse economic conditions

- Government legislation

- Cyber attacks

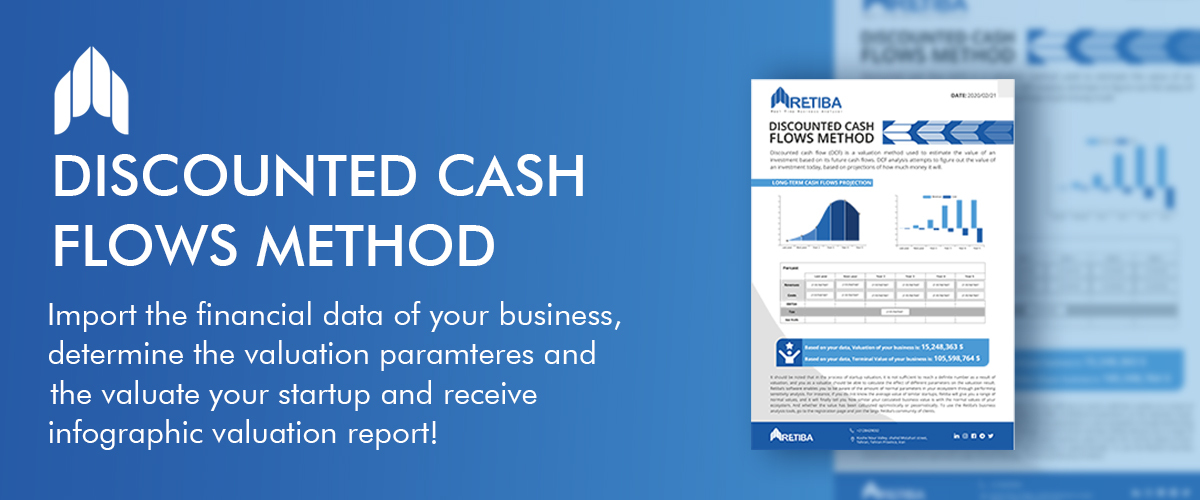

Your startup has crossed Death Valley, and it has had at least 2 funding rounds? Discounted Cash Flows (DCF)

Your startup has had at least one funding round, you are advised to use Multiples method for valuation.

Your startup is at pre-seed and seed funding rounds, you are advised to use the Score Cards Method, Risk Factors Summation method to value your startup.

This market may also be threatened by following risks:

In all different markets and industries, risk is always one of the factors that business founders should be sufficiently aware of. The first step is risk assessment is identification of risks in the market in order to perform risk management. The market of crypto assets may also be threatened by following risks:

- Technology risk

- Litigation risk

- Stage of business

- Funding risk

- Exit value risk